Cyphr Fund

Ready-made SaaS lending platform. Issue first loan in 2 weeks.

For your customers. Offer the convenience of applying for capital and grants online. With a responsive landing page, customers can access it effortless from any device, ensuring a seamless omnichannel experience.

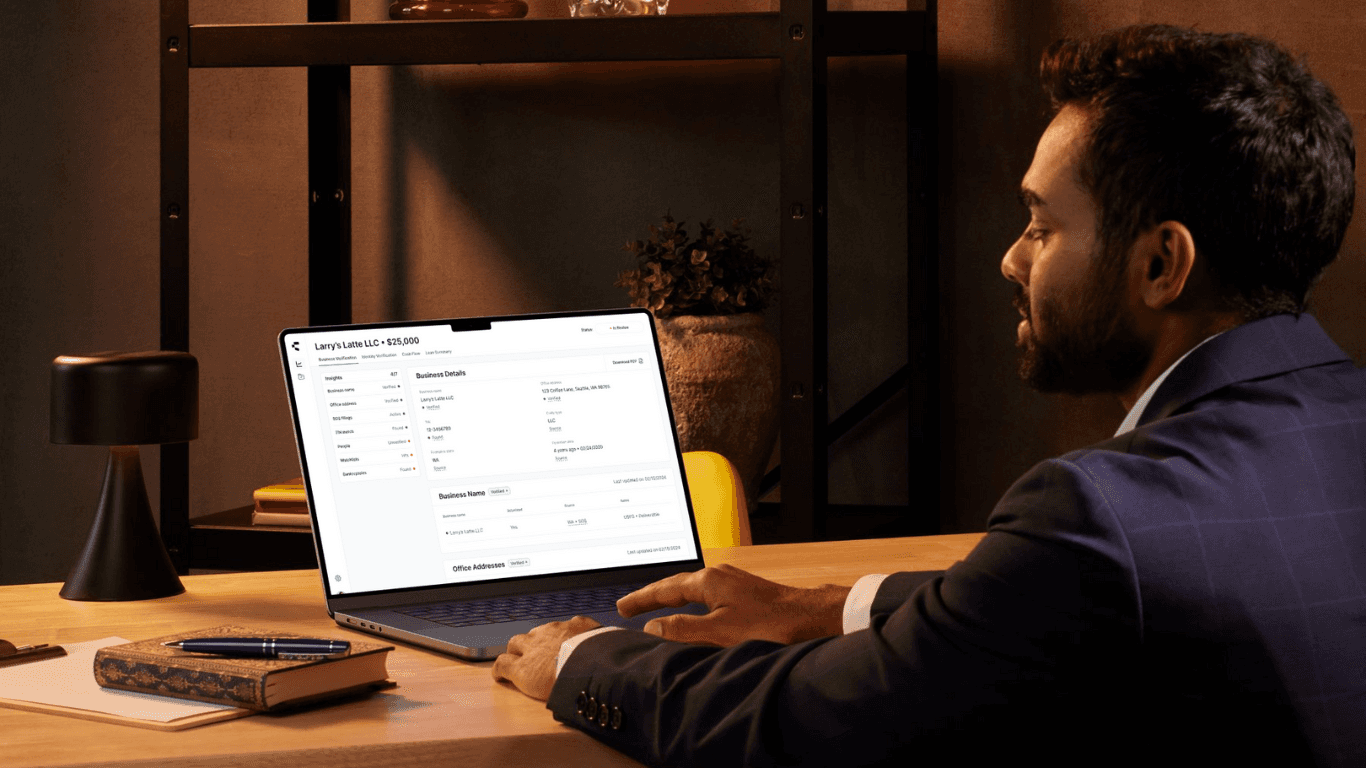

For your business. Boost efficiency with an all-in-one, scalable back office to process, screen, verify, and manage new applicants. Maximize staff efficiency, reduce costs, and gain operational flexibility.

Solution Approach

Offer your borrowers the convenience of applying online.

Use Cyphr to expedite your onboarding and verification workflow and ensure the fastest ROI while minimizing risk.

Why choose Cyphr Fund

14 Days to Launch

Experience a rapid implementation of our SaaS business lending platform within just 14 days. Upon you request, we offer flexibility to tailor the platform with additional features and integrations to meet your specific needs. With Fund, you can kickstart your lending business in a matter of days, not months, ensuring the quickest ROI possible. Embrace efficiency and seize the opportunity for a swift and successful launch.

Intuitive and east to learn

Empower your loan officers with a user-friendly SaaS lending system. No coding experience is required, as the software is designed to be simpler and more intuitive than even digital spreadsheets. Your credit managers can experience its ease firsthand by requesting a demo today. Empower your team with cutting-edge technology to streamline lending processes.

Grows with your business

Meticulously crafted using the latest software stack, ensuring long-term and reliable support for SaaS lending technology. Rest assured, our solution is built on a foundation of stability and security, backed by SOC2 certification, a proof of our commitment to safeguarding your data and maintaining the highest standards of protection. Partner with us to experience cutting-edge technology with unwavering reliability and peace of mind.

Future proof and secure

Out-of-the-box lending solutions are easily scalable to support the growth of your finance business from startup to enterprise. A powerful software engine maintains vast amounts of data and transactions for steady and smooth operation.